How Hard Money Georgia can Save You Time, Stress, and Money.

How Hard Money Georgia can Save You Time, Stress, and Money.

Table of ContentsSee This Report on Hard Money Georgia6 Easy Facts About Hard Money Georgia ExplainedThe 4-Minute Rule for Hard Money GeorgiaFacts About Hard Money Georgia Uncovered

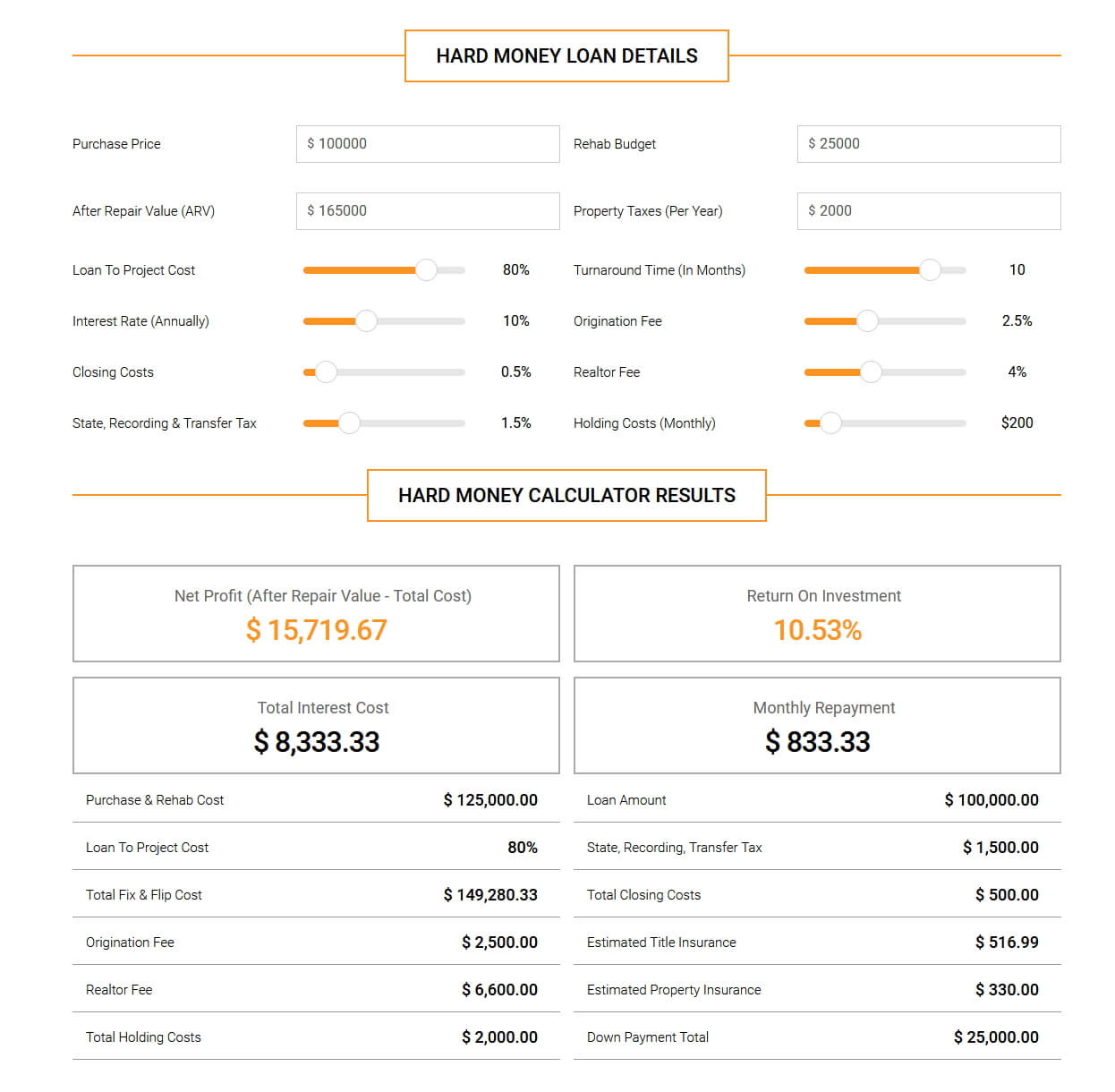

The optimum appropriate LTV for a hard money finance is usually 65% to 75%. On a $200,000 home, the maximum a hard cash lending institution would certainly be eager to offer you is $150,000.

By comparison, passion rates on difficult money fundings begin at 6. Difficult money loan providers commonly bill factors on your funding, in some cases referred to as source charges.

Points are usually 2% to 3% of the loan quantity. 3 points on a $200,000 financing would be 3%, or $6,000. hard money georgia. You might need to pay even more factors if your car loan has a greater LTV or if there are multiple brokers associated with the purchase. Although some lenders charge only points and also no various other costs, others have added prices such as underwriting charges.

Indicators on Hard Money Georgia You Need To Know

You can expect to pay anywhere from $500 to $2,500 in underwriting charges. Some difficult money lending institutions also bill prepayment charges, as they make their cash off the interest costs you pay them. That implies if you repay the funding early, you might have to pay an additional fee, contributing to the loan's expense.

This suggests you're more probable to be offered financing than if you made an application for a traditional home mortgage with a questionable or thin credit rating. If you require cash rapidly for restorations to flip a home commercial, a difficult cash lending can provide you the cash you require without the headache and paperwork of a standard home mortgage.

It's an approach investors use to purchase investments such as rental homes without utilizing a whole lot of their very own properties, and also hard money can be helpful in these situations. Although tough cash loans can be helpful for actual estate investors, they ought to be utilized with caution especially if you're a newbie to real estate investing.

If you default you could look here on your financing repayments with a tough money lending institution, the repercussions can be severe. Some finances are directly guaranteed so it can harm your credit report.

Hard Money Georgia Things To Know Before You Buy

To locate a trusted lender, speak with trusted property agents or home loan brokers. They might be able to refer you to lending institutions they have actually functioned with in the past. Tough money lenders likewise often go to investor meetings so that can be a great area to link with lenders near you.

Equity is the worth of the building minus what you still owe on the mortgage. The underwriting for house equity car loans also takes your credit scores background as well as income right into account so they often tend to have lower rate of interest rates as well as longer payment periods.

When it involves funding their following offer, real estate investors and business owners are privy to a number of providing options virtually created property. Each includes specific needs to access, and if utilized appropriately, can be of significant advantage to capitalists. One of these borrowing kinds is difficult money lending.

It can likewise be labelled an asset-based finance or a STABBL financing (short-term asset-backed bridge funding) or a bridge car loan. These are stemmed from its characteristic short-term nature and also the requirement for substantial, physical collateral, generally in the type of actual estate building. A difficult cash lending is a funding type that is backed by or safeguarded making use of a real estate.

Getting The Hard Money Georgia To Work

In the very same capillary, the non-conforming nature pays for the lenders an opportunity to pick their own certain needs. Consequently, requirements might differ significantly from lending institution to lending institution. If you are looking for a finance for the first time, the approval procedure might be relatively rigorous and also you might be called for to give added details.

This is why they are primarily accessed by realty business owners that would typically require rapid funding in order to not lose out on hot chances. Additionally, the loan provider primarily considers the value of the asset or building to be bought instead of the consumer's individual finance history such as credit rating score or earnings.

A conventional or bank loan may take up to 45 days to close while a difficult cash lending can be closed in 7 to 10 days, helpful hints sometimes sooner. The ease and also speed that difficult cash car loans supply stay a major driving force for why investor select to use them.